Peak season begins for the international transport markets. Our commercial leader at Europartners Ecuador has a valuable insight on the situation today.

Port congestion in Europe is still a major problem. There are delays in all links of the transport chain and the coordination of motorboats is quite complex; blank salings have been announced to mitigate the situation.

On the other hand, the global situation in terms of lack of equipment continues to impact Europe, China, South Asia and the main ports of the United States.

Although rates have fallen in recent weeks, shipping companies should be a little more flexible to help the market to sail through the situation we are facing – also impacted by the peak season, the lockdowns in recent months in Shanghai, port strikes in Europe and the west coast of the US.

At the beginning of our peak season, which always originates in the third quarter of the year, we don’t expect that spaces, equipment, and rates will stabilize in the short term.

All this conjuncture ends up affecting the international logistics market mainly on four fronts:

Peak season

High inflation and political uncertainty are the main trigger for today’s lack of consumer confidence. The result is financial speculation, which leads to an increase in orders – so as not to suffer with shortages – and a high demand for equipment for the international cargo transport.

Low capacity

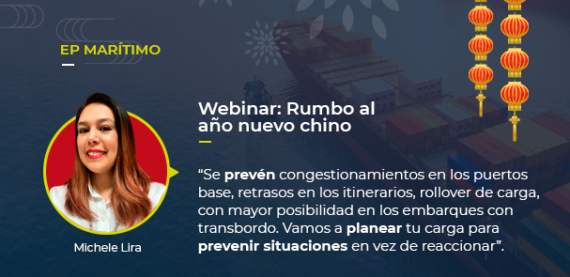

As I mentioned, congestion in ports in Europe causes delays that lead shipping companies to justify cargo rolling; blank sailings are already being announced and we are experiencing a significant lack of equipment.

The situation of equipment shortage will also increase more and more in the south of China, which shall impact on other ports in Europe and in the Americas that are already suffering with shortages, delays and cargo rolling.

Fuel surcharges

Shipping companies, although more open to negotiating rates nowadays, have increased their costs adding “warranty fees” to the bill to ensure a departure. The peak season impacts the market with the increase in fuel prices – Bunker Adjustment Factor (BAF).

Rate changes

The end of the lockdown in Shanghai, constant strikes at ports in Europe and at ports on the west coast of the United States (USWC) and the start of the peak season in this third quarter (3Q2022) may lead us to believe that container freight rates will increase – and will not stabilize in the short term.

“However, the significant drop in rates in the last two months is one of several contradictory indicators of what the container ship sector may hold in the future,” reports Mundo Marítimo.

The Chilean website listed other potential consequences:

- A possible even steeper fall in rates, increase in inventories and an increase in inflation, factors that suggest a slowdown in demand;

- While consumer spending and ocean services volumes remain strong (despite the projection of a decline in the coming months), signs point in the opposite direction of the three scenarios mentioned above.

What can Europartners Group do for you

At Europartners, we work to be more than a freight forwarder: we want to be your best strategic partner in logistics.

Our logistics consultants have the experience and ability to understand your most specific international transport needs, design together action plans to anticipate the risks of the current cargo transport market and provide you solutions tailored to your needs.

Highly specialized in risk management using the strategic foresight to offer time-sensitive and high-coordination services, we design solutions tailored to your requirements, enabling you to keep the dynamics of your supply chain and avoid line stoppages.

Contact us today to design your short- and long-term logistics plan. We are here for you, connecting minds to move the world.

ESPAÑOL

ESPAÑOL